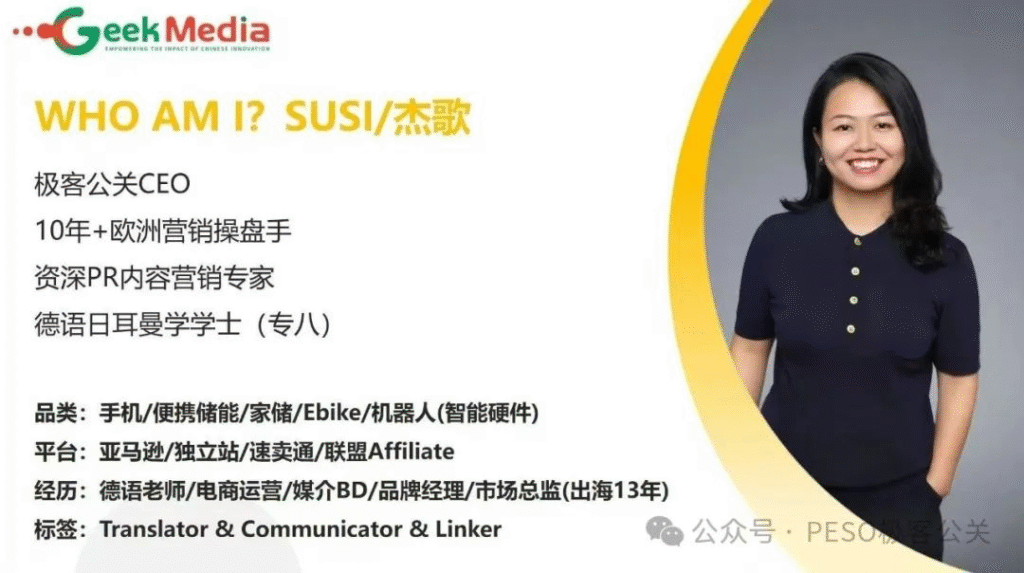

About Jie Ge / SUSI:

- CEO of Geek PR & Senior PR Content Marketing Expert in Europe

- Expertise: Mobile phones, smart wearables, portable energy storage, smart home

- Resources: Direct access to 100+ German-speaking PR media outlets (Tier1/2/3) + DOOH outdoor advertising (low cost)

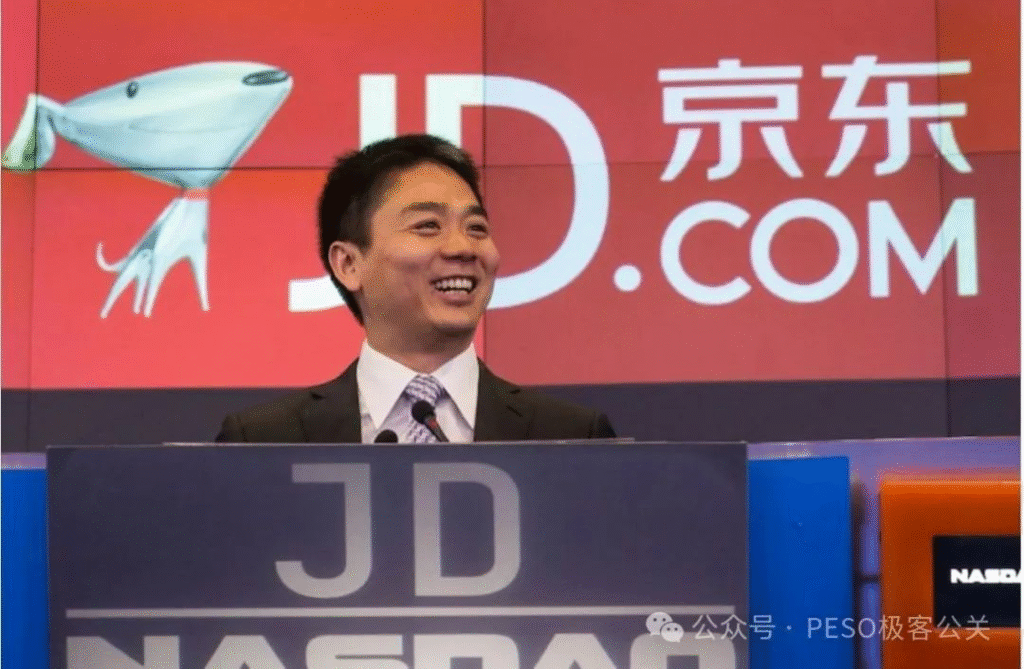

JD.com Overtaking on the Curve – Richard Liu’s Global Ambition

In the past few days, explosive news has spread across the overseas media: Chinese e-commerce giant JD.com is preparing to acquire Germany’s top consumer electronics retailers, MediaMarkt and Saturn! Reuters, Bloomberg, and The Wall Street Journal are following closely, while major German national and regional media are also reporting widely. Ceconomy, the parent company of MediaMarkt and Saturn, has confirmed negotiations are underway.

For those who have lived in Germany, MediaMarkt and Saturn hold a place similar to what Suning and Gome meant to Chinese consumers over a decade ago—absolute dominance in the consumer electronics retail market.

As a Chinese professional abroad, I feel immense pride upon hearing this news. Applause for Richard Liu!

For a long time, we believed China’s overseas edge lay in 'Made in China' products. But after living abroad for a few months, I’ve realized China’s true growing strength lies in digital service capabilities—mobile payments, efficient logistics, and instant customer service, which outclass many foreign counterparts.

This means China’s next stage of globalization is not just about products, but also about services going global—SaaS, software, training, and more.

Logistics alone may not give JD an obvious edge over Amazon FBA. But in real-time online customer service, JD has a huge advantage. In Germany, such issues are usually handled by email, dragging on for days or even weeks, often unresolved. This explains why Amazon is so popular in Europe and the US—it is 'customer friendly.' If customers are unhappy, refunds are immediate. Without this, many would still shop offline as it feels easier and faster.

Jens Klatt, market analyst at XTB, told Handelsblatt: 'JD’s acquisition could revitalize German retail by strengthening Ceconomy’s digital and logistics capabilities.' However, he also admitted this may raise concerns about foreign companies increasing control over German businesses.

Cultural Integration – The Invisible Challenge of Global Expansion

From what I know of Germans, such a large-scale acquisition will inevitably be a long-term, complex project involving law, finance, operations, and culture. While I don’t know much about law and finance, I do know e-commerce operations and corporate culture differences. Let’s take vacations as an example:

German employees’ vacation rights are enshrined in law, known for being generous. Full-time employees get at least 28 days of paid annual leave, plus 9–13 public holidays, plus sick leave, parental leave, etc.

In contrast: German employees work about 166 days a year, while Chinese employees often work no fewer than 286 days. In other words, when Germans are not working, we are still at work!

Riding the Wave – From Made in China to Created in China

Here’s another fact: in Germany, large stores, supermarkets, and restaurants usually close by 8 p.m. on weekdays and remain closed on Sundays. This contrasts with China’s 24/7 retail model, reflecting different societal values—efficiency versus life balance—understood and observed by everyone.

Given Richard Liu’s decisive style, a JD partnership with MediaMarkt and Saturn seems almost certain. The real challenge is blending China’s efficiency with German traditions and winning over consumers.

For those expanding abroad or planning to, JD is setting an example. Still think the German market is 'small'? If Richard Liu sees its potential, can you afford to underestimate it? Join the wave from Made in China to Created in China, from exporting products to exporting services!